Profit and loss statement

Before talking about P&L management, you need to understand a P&L statement.

A profit and loss statement for small business is also called an income statement. It is one of the three main financial statements that businesses use to assess their company’s health. The income statement shows you your business’s profits and losses during a specific time.

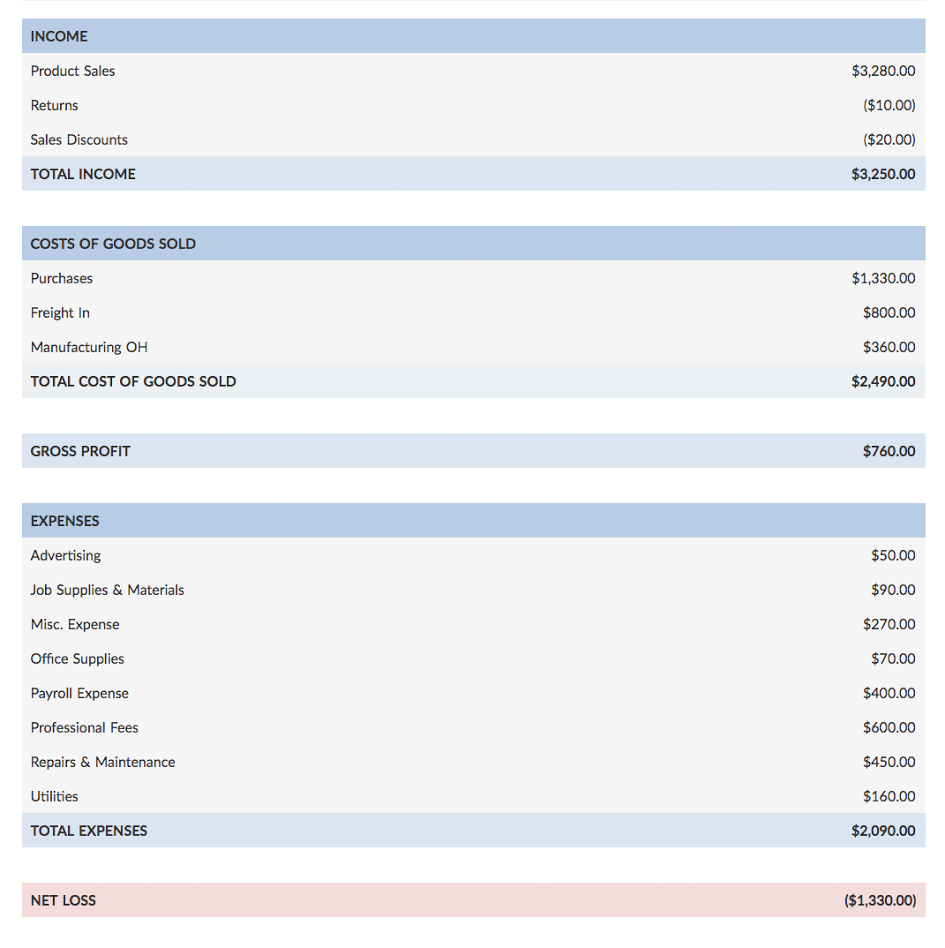

A profit and loss statement is laid out by categories to show you income, costs of goods sold, gross profit, expenses, taxes, and net profit/loss.

What is P&L management?

To survive, your business needs to have more profits than losses. Too many expenses can lead to debt or even small business bankruptcy.

Profit and loss management is the way you handle your business’s profits and losses. Managing P&L means you work toward having greater revenues and fewer expenses. You use your current profit and loss statement to determine your business’s profitability.

Looking at your P&L statement can also show you where you need to make changes in your business. You can learn where you need to cut business expenses and plan ways to increase your income when managing P&L.

You need to learn how to manage P&L responsibilities. Here are some ways to get started:

1. Create P&L statements

First, create profit and loss statements. Many business owners choose to do this weekly, monthly, quarterly, or annually.

The report lays out your income and expenses in black and white. The P&L statement breaks down income and expenses so they’re easy to read. That way, you can see where your money is going each accounting period.

Creating a profit and loss statement allows you to analyze your business and make financial decisions. Also, investors and lenders use financial statements to determine whether they should give or lend you money.

Here is an example of what a profit and loss statement looks like:

2. Compare P&L statements

Once you have your profit and loss statement for each accounting period, you can make comparisons.

Compare your current P&L statement to your past statements to determine whether your business is growing, stagnant, or declining. You can make decisions based on analyzing your statements.

For example, your January P&L statement showed a profit of $5,000, but your June P&L statement showed a loss of $1,000. Maybe you replaced a best-selling product with something else. Comparing your current and past P&L statements, along with conducting market research, might help you decide to bring back the old product.

You can also compare your P&L statement to a competitor’s. Doing so helps you locate problems within your own business. By looking at your competition’s P&L statements, you can see what areas your competitors spend money on and where they cut back.

3. Make changes to business finances

Managing profits and losses means making necessary changes to your finances. When you create and compare P&L statements, you see problems in your financial health. Recognizing these problems lets you come up with a new small business growth strategy.

You can eliminate certain expenses from your business by managing P&L. Once you see how much cash you dole out, you can shop around for new vendors to see if you can get better deals.

Sometimes, you have low cash on hand. If you extend credit, you might get customers who won’t pay you. When that happens, your business does not have as much incoming money as it should. You can adjust your invoice payment terms to get paid faster.

Managing profit and loss also means coming up with ways to make more sales. You might consider implementing strategic pricing (e.g., discounts) to draw customer traffic.

4. Meet with an accountant

Though managing profit and loss can be an internal job, it might also be good to talk with your accountant. Your accountant could help you with managing your profit and loss statement and decision-making.

If your business has losses, an accountant helps you find areas to slash expenses and manage other aspects of your money.

The importance of P&L management

If you want a healthy, growing business, you need to manage your profits and losses. Businesses that continually have more losses than profits need to make changes. You might need to adjust your payment terms, cut expenses, or make more sales.

Managing profit and loss influences your business strategies and decision-making. Grow your business through P&L management.

What is a profit and loss statement for small business?

A profit and loss, P&L, or income statement shows your business’s revenue, expenses, costs, and net income over a specific period of time. You can generate a statement for any time period, but the most common time frames include monthly, quarterly, or annually.

Business owners can use P&L statements to determine whether they need to improve their bottom line by increasing revenue or cutting costs.

To make your profit and loss statement, you must gather some information. You will need your business’s:

- Total income

- Cost of goods sold (COGS)

- Total expenses

How to create a profit and loss statement

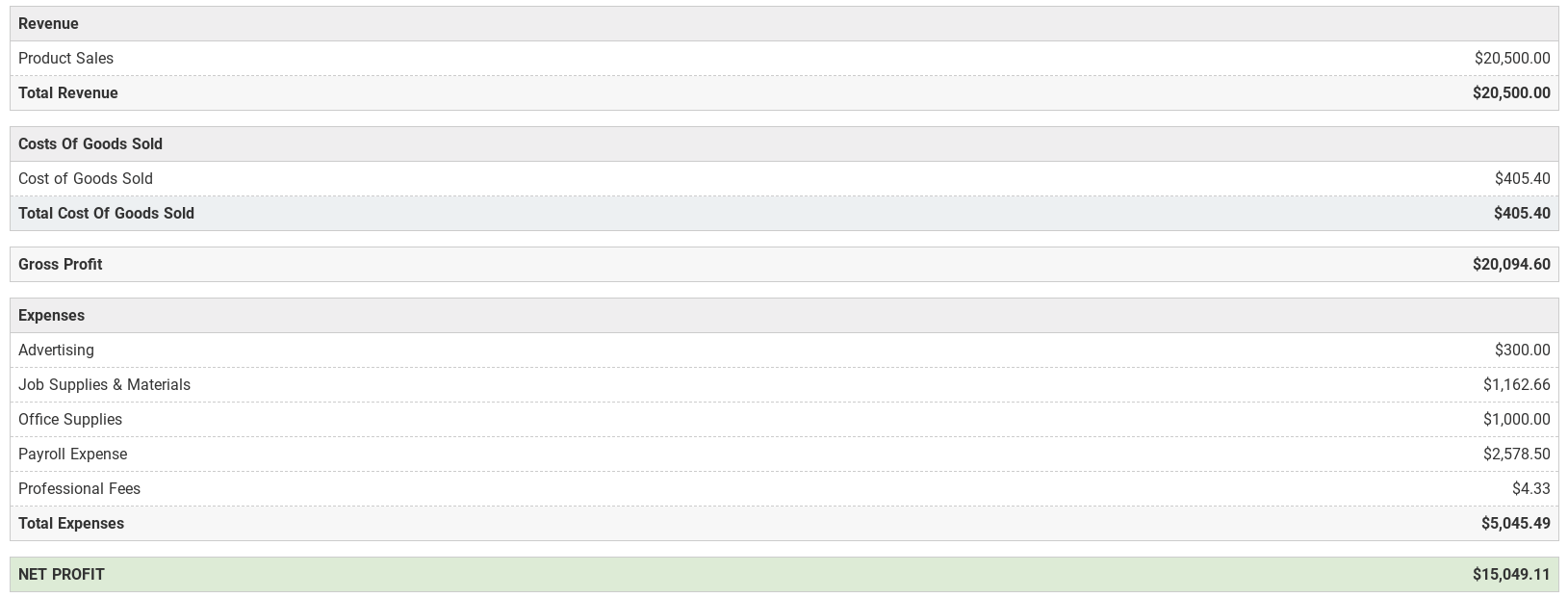

A typical profit and loss statement has four core sections:

- Income

- Expenses

- Cost of goods sold

- Net income

The above sections should be lines on your profit and loss statement.

When you create your statement, start with your income/revenue. Then, work your way down and subtract expenses.

Income

Income, or revenue, includes your business’s total sales. It also includes money you receive from selling things like equipment or receiving a tax refund.

Income is the first item you must list on your P&L statement. It should be a positive number and include any money you earned from sales.

Cost of goods sold

Your COGS is how much it costs to produce your goods or services. Your cost of goods sold includes direct material and direct labor expenses. To calculate your COGS, add your beginning inventory and purchases during the accounting period together. Then, subtract your ending inventory from your total.

Subtract your cost of goods sold from your revenue when you create your P&L statement to get your gross profit.

Expenses

Business expenses are costs you incur during day-to-day business operations, like insurance, marketing costs, and equipment.

Your expenses likely include operating expenses (OPEX). Operating expenses include things like salaries, rent, and utilities. These expenses keep your business going, but do not produce sales.

Subtract your expenses from your income to build your profit and loss statement.

Net income

Net income, or net profit, is the bottom line of your profit and loss statement. Net income is what is left after you subtract all of your expenses from your income.

Hopefully, you’ll see a net profit at the bottom of your profit and loss statement. If you have a net profit, your business is earning more than it spends. If your expenses outweigh your revenue, you will have a net loss.

Other items on your profit and loss statement

In addition to the five main sections above, your business might also need to report other items on your P&L statement. Depending on your industry, you might need to include other items like:

- Depreciation

- Financial costs/gains

- Extraordinary costs/gains

- EBIT/EBITDA

Keep in mind that the items reported on a profit and loss statement vary from business to business.

Depreciation

When you buy certain items, like equipment or a vehicle, the asset loses its value (depreciates) over time. Depreciation can be a significant number that impacts your business’ worth.

Depreciation is typically lumped together with COGS on your profit and loss statement.

Financial costs/gains

Financial costs and gains represent changes in your debts or investments. This line can either be positive or negative and shows you either have accrued interest in money you owe or have earned interest from your investments.

Extraordinary costs/gains

Extraordinary costs and gains generally refer to one-time impacts on your business. For example, say you sold a large, depreciated asset. That transaction is considered to be an extraordinary gain. Or, say you make a large, one-time purchase. That large purchase is an extraordinary cost.

EBIT/EBITDA

EBIT (Earnings Before Interest and Taxes) measures how profitable your business is over time. EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) shows your company’s operating performance.

Profit and loss statement example

Again, profit and loss statements vary depending on the business. Check out what your profit and loss statement might look like below:

What’s not included on a profit and loss statement?

There are a plethora of things you can include on your profit and loss statement. However, there are also some that you can’t include on your statement.

So, what don’t you include in your profit and loss statement?

Your profit and loss statement only shows your income, expenses, and costs. You don’t report your business’s assets, liabilities, and equity on your profit and loss sheet. As a brief recap, let’s go over what assets, liabilities, and equity include.

Assets include the physical and non-physical properties that add value to your business, such as inventory or trademarks.

Liabilities are existing debts that you owe to another business, organization, vendor, employee, or agency (e.g., loans).

Equity shows how much your business is worth and is the difference between your assets and liabilities.

Updating your profit and loss statement

At this point, you might be wondering, How frequently should I update my profit and loss statement? Great question.

How frequently you update your profit and loss statement ultimately comes down to your preference. However, certain factors can impact how often you update your P&L statement. For example, factors like your business’s sales, expenses, or working capital can affect when you update your statement.

You know your business inside and out. And, you know what factors impact your profit and loss statement. Determine how frequently you’re going to update your statement. If something at your company changes, make adjustments to your frequency (e.g., monthly to quarterly).

When you review your P&L statement, be on the lookout for signs that your business is on the right track. And, watch out for warnings that you might need to make some changes.

Importance of profit and loss statement for small business

Profit and loss statements play an important role in your business. They give you the opportunity to review your net income and can help you make important financial decisions.

Profit and loss statements can help you:

- Create other business financial statements

- Show shareholders where your business stands financially

- Give you insight into your business’s net earnings (e.g., positive or negative)

You can compare and contrast your recent and past profit and loss statements to get a clear picture of your company’s financial standings. Regularly referencing your statements can help you stay on top of your finances and ensure you are on the right path for the future.